REQUIREMENTS:

< WHEN AVAILING PAG-IBIG OR BANK FINANCING IN YOUR HOUSE PURCHASE >

I. TO BE SUBMITTED WITHIN TEN (10) DAYS FROM DATE OF RESERVATION

-

- Clear Photocopy of one (1) government issued valid IDs (front and back) of borrower, spouse, and attorney-in-fact (with 3 specimen signatures) – Please take note that the Financing Institution may require an additional Valid ID if warranted.

Sample Valid Identification Card:

-

- Photocopy of Proof of Income, either one of Payslip, Income Tax Return w/ Financial Statement, Certificate of Employment and Compensation, OFW Work Contract

- Execution of Special Power of Attorney (SPA) – if applicable

- Photocopy of Birth Certificate and Marriage Contract

- For widow/widower, photocopy of death certificate of spouse

- Duly Filled up Buyer/Borrower Information Sheet

- Tax Identification Number of Borrower and Spouse

- Six (6) pcs 1×1 Picture (Buyer and Spouse)

- Post Dated Checks covering any installments

II. REQUIREMENTS FOR THE LOAN APPLICATION WITH THE FINANCING INSTITUTION FOR ISSUANCE OF THE NOTICE OF APPROVAL (Between 1st to 4th Month depending on the percentage of house construction)

Pag-Ibig Financing:

-

- Duly Filled up Housing Loan Application Form

- Notarized/Consularized Special Power of Attorney

- Submit latest Pag-Ibig Contribution Payment Ledger

- If Borrower has existing Multi-Purpose Loan (MPL), submit updated MPL Payment Ledger/Receipt

- If Borrower has existing Housing Loan, submit updated Housing Loan Payment Ledger

- Submission of Proof of Income for Credit Investigation/Pre-Evaluation of the Financing Institution:

- For locally employed: Notarized Certificate of Employment or Income Tax Return w/ BIR Stamp and latest 1 mo. Payslip (certified true copy by HR/Head of Office)

Sample Certificate of Employment (Notarized)

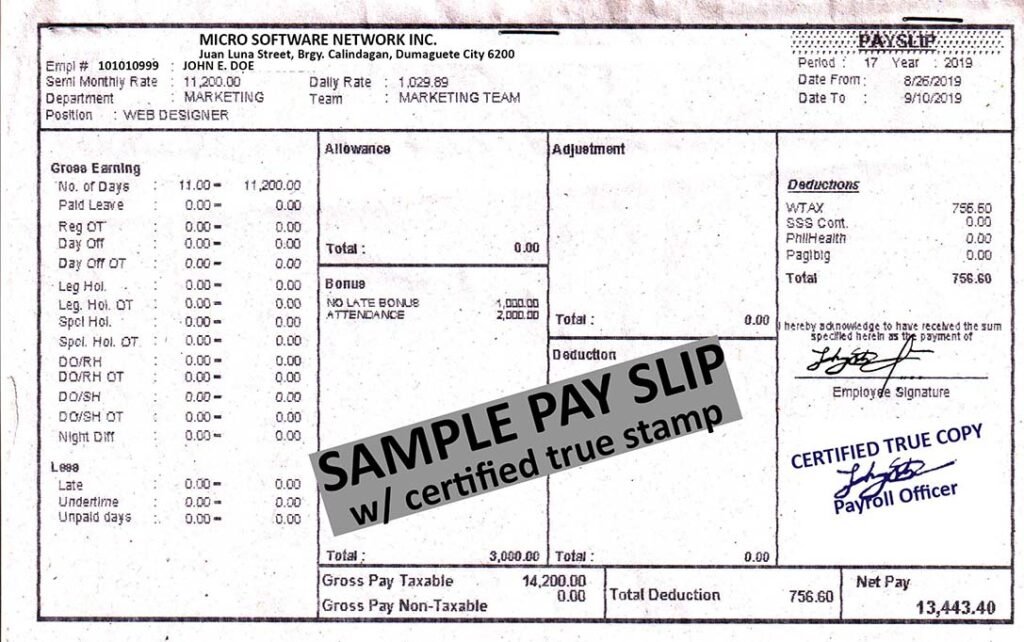

Sample Pay Slip (with Certified True Stamp)

-

-

- For Self Employed: Income Tax Return w/ stamp and Audited Financial Statements and Official Receipt of tax payment from Bank, DTI Registration, and Mayor’s Permit

- For Pag-IBIG Overseas Filipino Workers Members: Employment Contract with POEA Stamp or Employer’s Certificate of Income (with English translation if in foreign Language), and latest 1 mos. Payslip

-

Sample Certificate of Employment/Contract (with POEA Stamp)

-

-

- For Online Job: Certificate of Engagement/Contract with Compensation and Latest 6 months Bank Statement consistent with Proof of Income

- All other Documents, Forms or additional Proof of Income as maybe required by Pag-Ibig

-

Bank Financing:

-

- Duly filled up Bank Forms

- Notarized/Consularized Special Power of Attorney

- Latest Certificate of Employment and Payslip or ITR w/ BIR stamp and Financial Statement

- Latest 6 months Bank Statement consistent with Proof of Income (as needed)

- All other Bank Forms or additional Proof of Income as required by the financing Bank

III. REQUIREMENTS TO BE COMPLIED/SUBMITTED PRIOR TO TAKEOUT/LOAN RELEASE (Between the issuance of the Notice of Approval / Letter of Guaranty to completion of the unit):

Pag-Ibig Financing:

-

- Validation with Pag-Ibig Fund (appearance with Pag-Ibig is required)

- Latest Proof of Income and/or Additional Proof of Income as maybe required

- Updated payments for Pag-Ibig Member Contribution, MPL and/or Housing Loan

- House Acceptance and all others as maybe required by Pag-Ibig and/or the Developer

Bank Financing:

-

- Final Interview/Appearance with the Bank

- Signature on the Mortgage Documents, Notice of Approval and other documents from the Bank

- Opening and maintaining of savings/current account with the concerned Bank

- Payment of Bank Fees and Insurance Premiums as maybe required

- Latest Proof of Income and/or Additional Proof of Income as maybe required

- House Acceptance and all others as maybe required by the Bank and/or the Developer

-